colorado estate tax exemption

Corporate partnership or other entity for estate planning. Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicatedThats especially true for any situation involving.

State By State Estate And Inheritance Tax Rates Everplans

At least 65 years old on January 1 of the year in which he or she qualifies.

. However estate income tax returns can be fairly complex even if there is very little income. The tax year for which you are seeking the exemption. The Colorado estate tax is calculated as the share of the estate that includes Colorado property multiplied by the state death tax credit.

Late reports filed after the April 15 deadline must be accompanied by the 250 late filing fee. You can also own a life. The following are the federal estate tax exemptions for 2022.

Timely filings with a 75 filing fee per report are due by April 15. Colorado seniors are eligible for a property tax exemption if they are. In 2002 the state granted 123380 exemptions and paid counties about 62 million in.

You can own it with your spouse or with someone else. For property tax years commencing on or after January 1 2022 the bill. Exempt agricultural sales not including farm and dairy equipment Wholesale sales including wholesale sales of ingredients and component parts Sales made to nonresidents or sourced to.

The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to. A property tax exemption is available for senior Colorado residents or surviving spouses provided they meet the requirements. Fifty percent of the first 200000 in actual property value is exempt from property taxation.

The requirement to collect tax applies regardless of. Colorado statute exempts from state and state-collected sales tax all sales to the United States government and the state of Colorado its departments and institutions and its political. Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715.

In general any retailer making sales in Colorado is required to collect the applicable state and state-administered local sales taxes. There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability homestead exemption that is equal to 50 of the first 200000 of. Withdrawn Prior to RC Hearing.

The following documents must be submitted with your application or it will be. 2021-2022 92 - Social Security Income Exemption from State Income Tax. Tax Exemptions No state exemptions are allowed.

Are the current property owner of record. Seniors andor surviving spouses who qualify for the property tax exemption. Individuals can exempt up to 117 million Married couples can exempt up to 234 million The annual gift exclusion is 15000.

You do not have to be the sole owner of the property. A qualifying senior must be 65 years of age or older at the end of the income tax year for which the credit is claimed and have income that is less than or equal to 65000 adjusted for. Increases the maximum amount of actual value of the owner-occupied residence of a qualifying senior or veteran with a.

Sales Taxes In The United States Wikiwand

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Colorado Amendment E Tax Relief For Gold Star Spouses

Colorado Estate Tax Do I Need To Worry Brestel Bucar

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

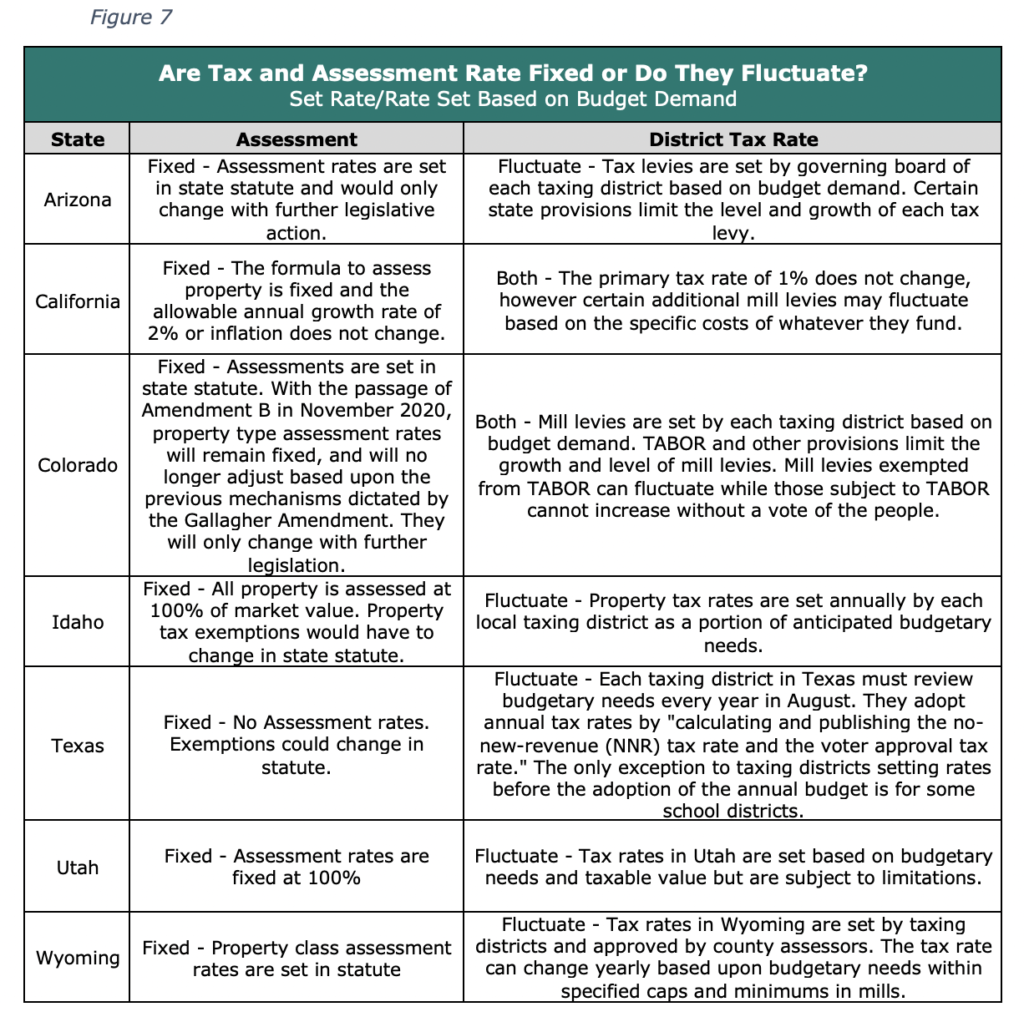

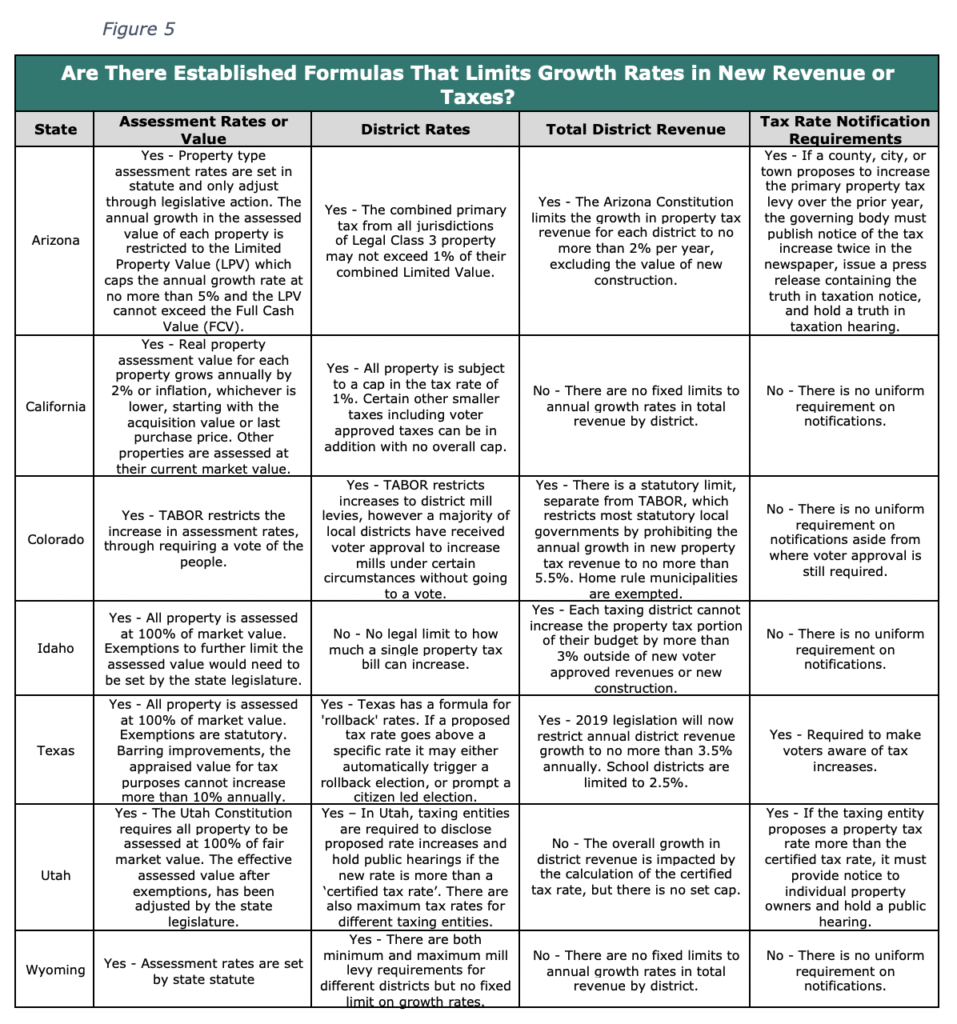

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Estate Tax The Ultimate Guide Step By Step

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Gift Money Now Before Estate Tax Laws Sunset In 2025 Press Enterprise

Colorado State Tax Guide Kiplinger

Estate Tax Exemption For 2023 Kiplinger

Estate Tax And Date Of Death Dod Appraisal Services Colorado Appraisal Consultants

Individual Income Tax Colorado General Assembly

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj