how far back does the irs go to collect back taxes

Ad Owe back tax 10K-200K. IRS Previous Tax Returns.

How Long Can The Irs Attempt To Collect Unpaid Taxes

We work with you and the IRS to settle issues.

. How Many Years Can The Irs Collect Back Taxes. If you dont set up a plan and avoid paying the IRS altogether the IRS can and likely will put their collections department on the case. Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Apply For Tax Forgiveness and get help through the process. IN GENERAL the IRS has 3 years from the. The IRS can go back up to.

After this 10-year period or. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts.

Posted on Feb 28 2013. Most of the time the IRS. There is an IRS statute of limitations on collecting taxes.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. How many years can the IRS collect back taxes. Only Go Back Six Years.

See if you Qualify for IRS Fresh Start Request Online. Need help with Back Taxes. Once you file a tax return the IRS only has a decade to collect your tax liability by levying your wages and bank account or filing a.

In most cases the IRS goes back about three years to audit taxes. Theoretically back taxes fall off after 10 years. See if you Qualify for IRS Fresh Start Request Online.

It is true that the IRS can only collect on tax debts that are 10 years or younger. Created By Former Tax Firm Owners Based on Factors They Know are Important. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

End Your Tax Nightmare Now. Ad Owe back tax 10K-200K. The time period called statute of limitations within which the IRS can collect a tax debt is generally 10 years from the date the tax was officially assessed.

Ad Owe the IRS. If the IRS goes back to collect on someones unfiled tax returns before they take the opportunity to rectify the problem they could face immense fees. When the statute of limitations will expire or how far back the IRS can go depends on a number of variables.

To figure out your CSED you can check the date on correspondence the IRS sent you about unpaid taxes or ask the agency for a transcript of your account. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Start with a free consultation.

An IRS Audit Can. At the very most the IRS will go back six years in an audit but that only happens if the agency identifies a serious error. Owe IRS 10K-110K Back Taxes Check Eligibility.

Reduce Your Back Taxes With Our Experts. The IRS 10 year statute of limitations starts on the day that your. You May Qualify for an IRS Forgiveness Program.

However that 10 years does not begin when you neglect either accidentally or willfully to file. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the. How far back can the IRS collect unpaid taxes.

Ad The IRS contacting you can be stressful. Owe IRS 10K-110K Back Taxes Check Eligibility. For most cases the.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. After this 10-year period or statute of limitations has expired the IRS can. Ad See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems.

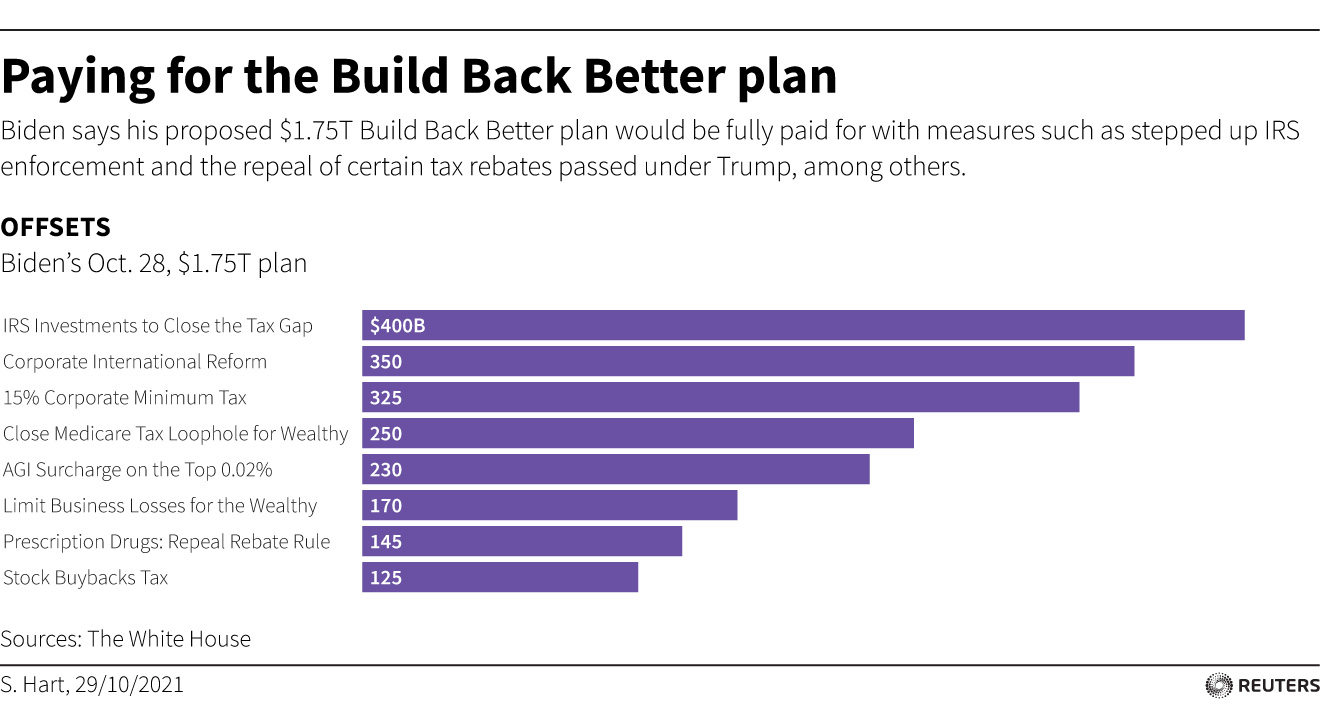

Irs Plan To Collect 400 Bln In Unpaid Taxes Relies On Deterrence Treasury S Adeyemo Reuters

How Far Back Can The Irs Collect Unfiled Taxes

How Far Back Can The Irs Audit You New 2022

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

How Long Does The Irs Have To Collect Back Taxes Brinen Associates

What Is The Interest Rate The Irs Charges For Back Taxes

New York State Back Taxes Find Out Tax Relief Programs Available

Can The Irs Collect After 10 Years Fortress Tax Relief

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Do You Owe Back Taxes To The Irs Or State You Know You Owe Back Taxes To The

Everything You Need To Know About Irs Tax Forgiveness Programs

Bringing The Irs Back To Square One Or Funding The Expanded Mission Fedmanager

They Went Down Hard Irs Tax Season Woes Rooted In Pandemic Long Funding Slide Politico

Owe Back Taxes The Irs May Grant You Uncollectible Status

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

The Irs Is Failing To Collect Billions In Back Taxes Owed By Super Rich Americans

Tax Resolution Levy Associates

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

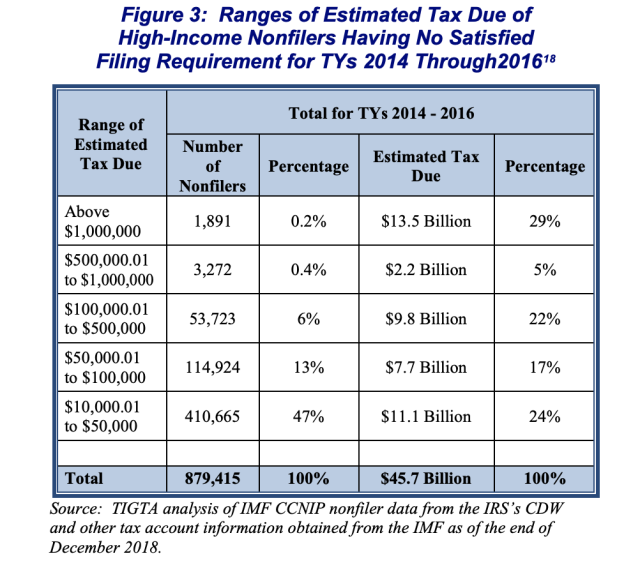

Irs Fails To Pursue High Income Nonfilers Who Owe 46 Billion In Back Taxes Watchdog Says